United States Electric Golf Cart market is projected to reach USD 354.9 million by 2035, expanding at a 4.5% CAGR

The United States Electric Golf Cart Market is segmented by application, ownership, and type from 2025 to 2035.

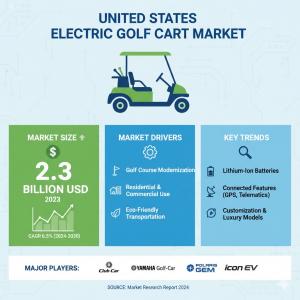

NEWARK, DE, UNITED STATES, November 7, 2025 /EINPresswire.com/ -- United States Electric Golf Cart market is valued at USD 228.5 million in 2025 and is projected to reach USD 354.9 million by 2035, expanding at a 4.5% CAGR. Growth is driven by increased adoption beyond traditional golf courses into retirement communities, resort developments, industrial campuses, and university grounds. Lithium-ion batteries, extended seating options, and off-road-ready configurations are reshaping the mobility landscape. Market acceleration is being fueled by demand for sustainable, low-emission solutions and the trend toward highly personalized and multi-functional electric vehicles.

As electric mobility becomes mainstream in gated communities, hospitality, and commercial sectors, stakeholders across OEMs, aftermarket providers, and fleet operators face both opportunity and competitive pressure. Personal and commercial buyers are prioritizing longer range, fast charging, customization, and digital connectivity in their electric carts. With these factors in play, manufacturers who integrate smart technology, durable powertrains, and flexible design are positioned to capture the highest returns.

Get access to comprehensive data tables and detailed market insights — request your sample report today!

https://www.futuremarketinsights.com/reports/sample/rep-gb-21851

Market context

The U.S. Electric Golf Cart market is moving from recreational-focused adoption to broader lifestyle and utility applications. Buyers are no longer just golfers or resort operators; they include retirees using carts as primary transport within communities, university campuses for student and staff mobility, and commercial establishments for last-mile deliveries or internal transport. Regulatory clarity, environmental consciousness, and rising disposable income are creating repeatable demand. OEMs and aftermarket creators are responding with modular carts, lithium-ion battery integration, and app-enabled fleet management solutions.

Fast facts

• 2025 market size: USD 228.5M

• 2035 forecast: USD 354.9M

• CAGR 2025–2035: 4.5%

• Leading application: Golf courses

• Ownership model: Fully owned dominates

• Hot regions: Southeast, Southwest, West, Northeast

• Key product trends: Lithium-ion powertrains, off-road upgrades, smart dashboards

What is winning and why

Performance, predictability, and usability are the core drivers of adoption. Buyers are looking for electric carts that deliver precise pedal response, effective heat management, and reliable range. Features like extended lithium-ion range, smart braking, and app-based diagnostics define top-performing models.

• Power adders: Enhanced lithium-ion range and optional solar integration increase operational flexibility and reduce downtime.

• Chassis & Brakes: Suspension and braking upgrades ensure rider comfort, stability, and safety on various terrains.

• Digital tuning: GPS, fleet management, and remote diagnostics improve operational efficiency and customer satisfaction.

Where to play

The U.S. market sees a dual approach with aftermarket customization complementing first-fit OEM offerings. Fleet buyers prioritize reliability, while lifestyle buyers emphasize personalization and aesthetic appeal. Strategic deployment across regions ensures market penetration across recreational, commercial, and residential segments.

• California 4.6% CAGR: Strong resort development, environmentally focused communities, and early adoption of solar and lithium-ion carts.

• Florida 4.7% CAGR: Retiree-focused developments and year-round golf courses drive high adoption and aftermarket customization.

• New York 4.2% CAGR: Urban campuses, parks, and semi-urban communities fuel demand for street-legal, connected LSVs.

• Texas 4.8% CAGR: Golf-centric cities, gated communities, industrial campuses, and ranches generate growth across utility and lifestyle segments.

Regional insights

• Southeast USA: Florida, Georgia, and the Carolinas lead adoption. Retirement communities, warm weather, and resort infrastructure allow year-round use. Utility and commercial applications for hospitality, healthcare, and logistics are expanding. Customization and personalization remain top priorities.

• Southwest USA: Texas, Arizona, and New Mexico benefit from sprawling resorts, golf culture, and desert-friendly electric cart deployments. Utility models with towing and cargo features are in high demand. The region also sees strong uptake of street-legal lifestyle carts.

• West USA: California, Nevada, and Colorado are centers for sustainable adoption. Luxury and tech-enhanced electric carts are being deployed for resort, urban, and residential mobility. California’s clean energy policies accelerate solar-electric integration.

• Northeast USA: New York, Pennsylvania, Massachusetts, and New Jersey drive adoption in retirement communities, campuses, and resort properties.

Despite seasonal weather constraints, weatherized designs and all-season tires are enabling year-round operations.

Ownership and usage patterns

Fully owned electric carts dominate due to their flexibility, personalization potential, and long-term value. Residents in retirement communities, gated developments, and resort neighborhoods prefer ownership for daily mobility, off-course leisure, and community travel. Commercial operators benefit from predictable maintenance, customizable fleets, and compatibility with smart fleet management systems. Rented models are limited to temporary or event-driven usage, while ownership ensures repeat engagement and higher aftermarket spend.

Competitive landscape

Major players like Club Car, E-Z-GO, and Yamaha collectively hold significant market share, while smaller manufacturers and regional providers account for the remainder. Club Car leads with 18–22% market share and has introduced next-gen Tempo lithium vehicles featuring StopSmart automatic park brakes and redesigned dashboards. E-Z-GO’s Liberty LSV and Yamaha’s DRIVE H2 hydrogen concept demonstrate ongoing innovation in electric, low-emission mobility. Other manufacturers, including Columbia Vehicle Group and Garia, focus on production expansion, customized builds, and high-performance feature integration.

Opportunities and technology trends

• Lithium-ion battery adoption improves range, charging speed, and durability.

• Solar-powered carts and semi-autonomous vehicles enable expanded commercial and residential use.

• GPS-enabled fleet management and remote diagnostics enhance operational efficiency.

• Customization demand drives aftermarket revenue from wraps, performance kits, and interior upgrades.

• Integration into urban mobility and smart communities expands non-golf applications.

For access to full forecasts, regional breakouts, company share analysis, and emerging trend assessments, you can purchase the complete report here: Buy Full Report – https://www.futuremarketinsights.com/checkout/21851

Actionable next steps

R&D

• Expand lithium-ion battery capacity and fast-charging solutions.

• Optimize lightweight composite materials for chassis and body panels.

• Enhance calibration libraries and software for smart fleet management and app integration.

Marketing & Sales

• Showcase dyno-tested range, performance, and durability.

• Promote bundled packages combining lifestyle and utility features.

• Engage creators, fleet operators, and influencers for experiential installs.

Regulatory & QA

• Ensure emissions, noise compliance, and DOT street-legal approvals.

• Maintain detailed fitment, safety, and warranty documentation.

• Streamline customer guidance for installation, usage, and service coverage.

Sourcing & Operations

• Dual-source critical batteries, electronics, and suspension components.

• Pre-kit popular configurations for regional warehouses.

• Enable on-demand assembly and seasonal production flexibility.

Three quick plays this quarter

• Launch retrofit kits with lithium-ion upgrades for existing fleets.

• Pilot solar-charged packages for premium lifestyle carts.

• Test autonomous fleet deployment in gated communities and campuses.

The take

The U.S. Electric Golf Cart market is transforming from a niche recreational sector to a multi-purpose mobility solution. Reliable batteries, smart fleet management, and customizable design ensure repeatable adoption and long-term revenue growth. OEMs and aftermarket operators who focus on performance, safety, and personalization will capture both immediate market share and sustained customer loyalty.

Media line

For analyst briefings or custom insights by product, application, and region, contact Future Market Insights.

Similar Industry Reports

United Kingdom Interesterified Fats Market

https://www.futuremarketinsights.com/reports/united-kingdom-interesterified-fats-market

United Kingdom Car Rental Market

https://www.futuremarketinsights.com/reports/car-rental-in-uk

United Kingdom Veneered Panels Market

https://www.futuremarketinsights.com/reports/united-kingdom-veneered-panels-market

United Kingdom Women's Footwear Market

https://www.futuremarketinsights.com/reports/united-kingdom-womens-footwear-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.